P

poolmagazine

As part of my day job, I'm the Editor of Pool Magazine, a trade publication for the pool & spa industry. This week we were inundated with reports from California homeowners who told us that their insurance policy had been canceled. There were two commonalities among the reports that should be concerning to pool owners.

1) Each of the homeowners who received a notice of non-renewal had recently drained their swimming pool.

2) Each had received notice without an inspector or insurance adjuster ever having set foot on the property. The carrier had cited aerial images in their explanation as to how a determination had been made.

I myself live in a very rural area in Northern California where PG&E is the local utility provider. We are prone to wildfires and earlier this summer I received a notification that PG&E would begin using drones as part of an initiative to help them identify potential wildfire risks. It's clear that insurance carriers are also following suit and using drones to make a liability determination.

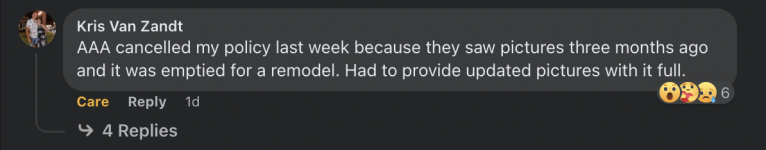

I asked a representative with AAA why a drained pool would present a higher liability risk for carriers and she told me that basically, a drained pool represents a gigantic hole in the backyard that insurance companies look at as a much higher risk. It's definitely something pool owners particularly in California need to concern themselves with, especially if they are thinking of draining their pool for any reason. One homeowner I spoke with said their policy was canceled after AAA received images of their pool which was drained for a remodel months earlier.

Draining Pool Costs Elderly Woman Her Homeowners Insurance

1) Each of the homeowners who received a notice of non-renewal had recently drained their swimming pool.

2) Each had received notice without an inspector or insurance adjuster ever having set foot on the property. The carrier had cited aerial images in their explanation as to how a determination had been made.

I myself live in a very rural area in Northern California where PG&E is the local utility provider. We are prone to wildfires and earlier this summer I received a notification that PG&E would begin using drones as part of an initiative to help them identify potential wildfire risks. It's clear that insurance carriers are also following suit and using drones to make a liability determination.

I asked a representative with AAA why a drained pool would present a higher liability risk for carriers and she told me that basically, a drained pool represents a gigantic hole in the backyard that insurance companies look at as a much higher risk. It's definitely something pool owners particularly in California need to concern themselves with, especially if they are thinking of draining their pool for any reason. One homeowner I spoke with said their policy was canceled after AAA received images of their pool which was drained for a remodel months earlier.

Draining Pool Costs Elderly Woman Her Homeowners Insurance